Let’s find out together, shall we? In this post I’ll look at the current state of bitcoin, both in terms of technology and its usage.

Obligatory disclaimer: this post is not financial advice. You’re responsible for any action you take based on this post.

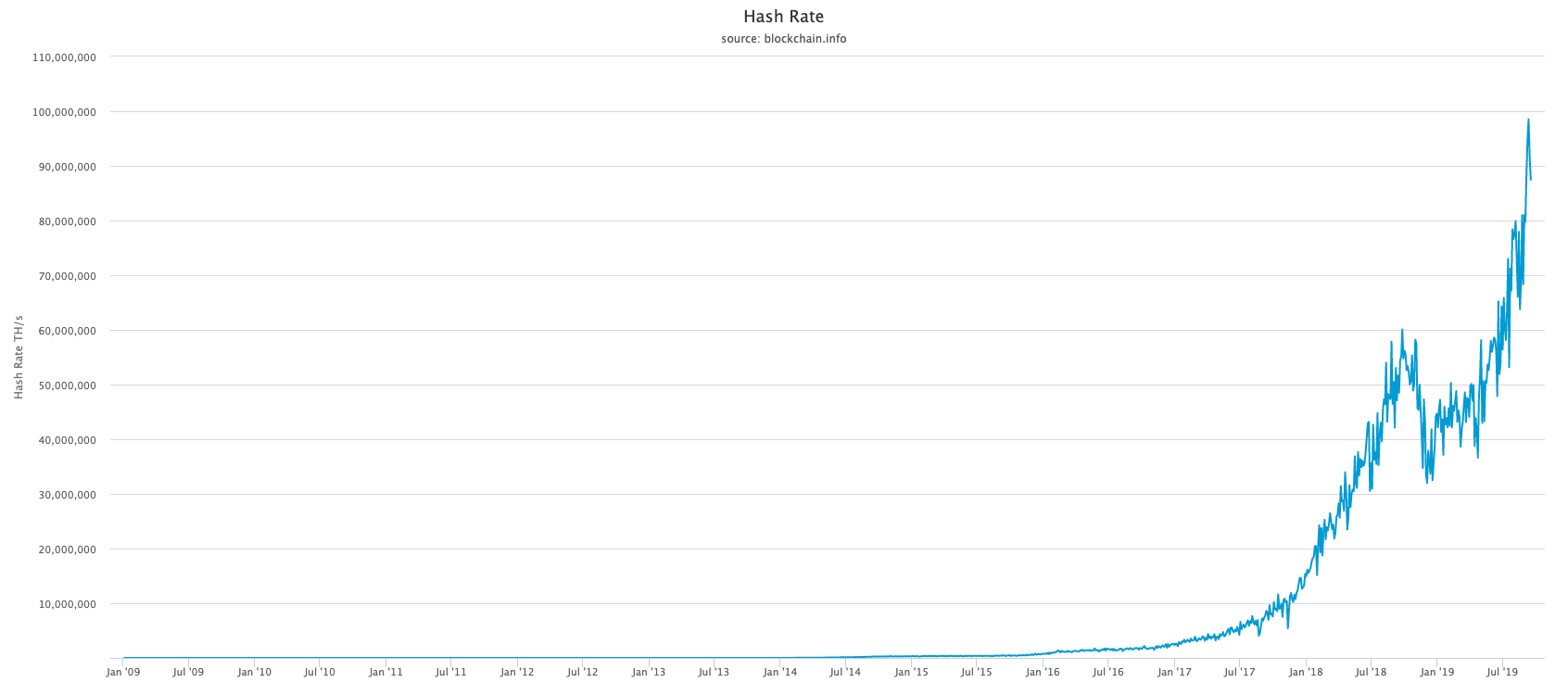

Network hash rate

Also known as: mining.

The bitcoin network is protected by miners all around the world that provide computational power. The more compute power that is thrown at the bitcoin network, the safer it becomes and the harder it gets to undo transactions and double spend them (pay the same bitcoin to 2 different people, each thinking they have received valid bitcoin).

The hash rate is expressed as “hashes per second”. The more there are, the more calculations get done every second to protect the network.

Chart provided by blockchain.com

The bitcoin network reached a peak of 100 exahash per second (EH/s) a few days ago. If you consider it reached ~11 EH/s at the peak of the 2017 price bubble and has been increasing ever since, it’s showing a lot of strength there.

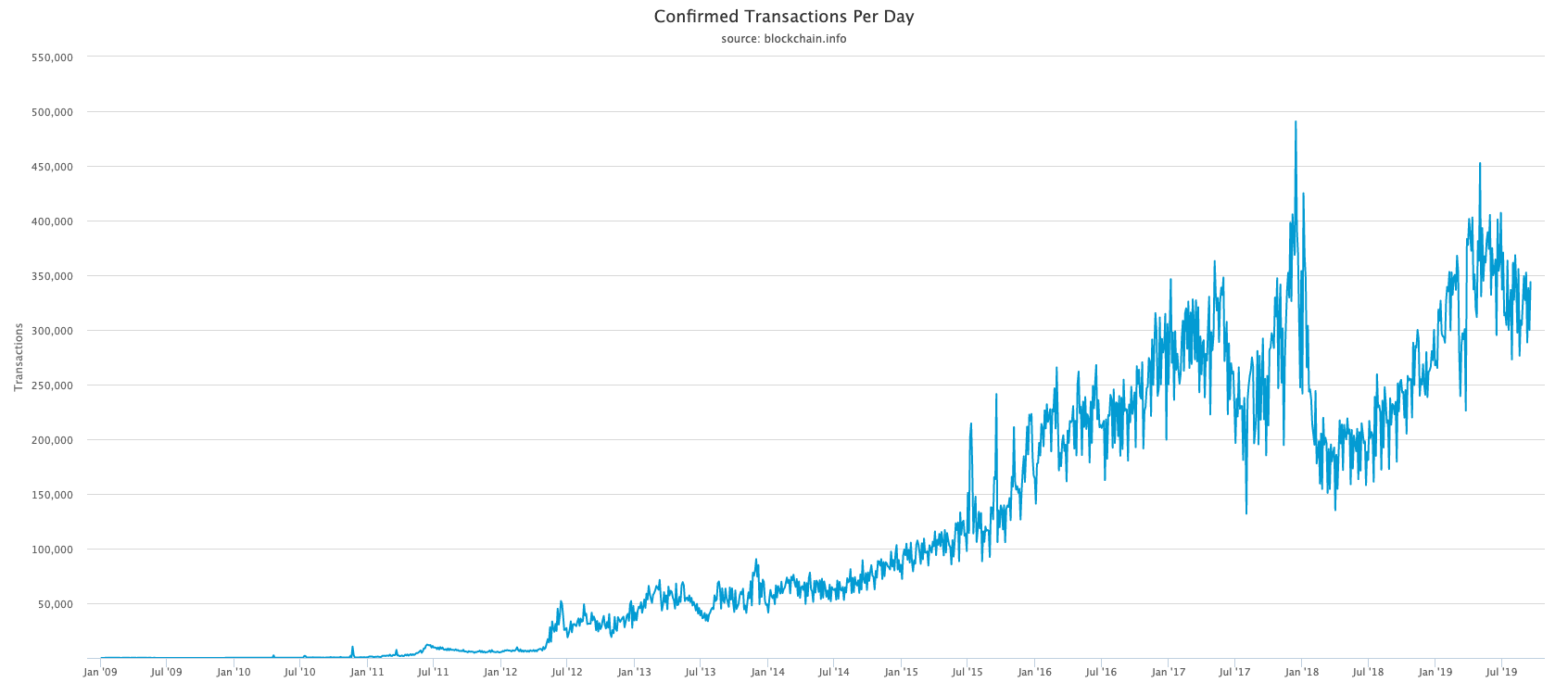

Transactions per day

While there are discussions about what bitcoin really is (a store of value like gold or a medium of exchange like money), one valuable metric to look at is how the current network is being used.

Are people using it? Are transactions being sent between individuals? What kind of value transfers are there?

First, let’s look at the transactions per day that got confirmed.

Chart provided by blockchain.com

While it doesn’t tell the whole story, it again shows signs of increased traffic. With improvements like transaction batching and the uprising of layer-2 protocols like Lightning, this should continue to rise slowly.

Smaller value transactions will start to move more and more off-chain though, to reduce transaction fees and speed up settlement between 2 parties.

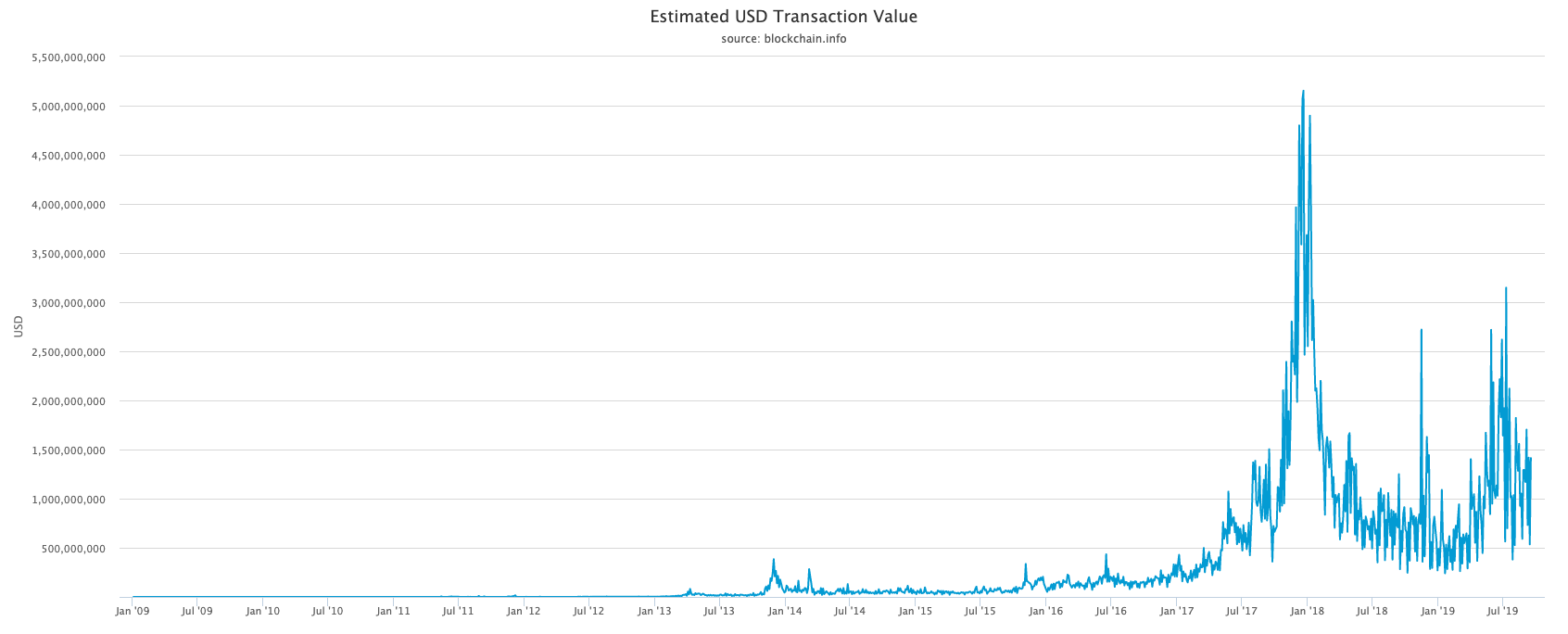

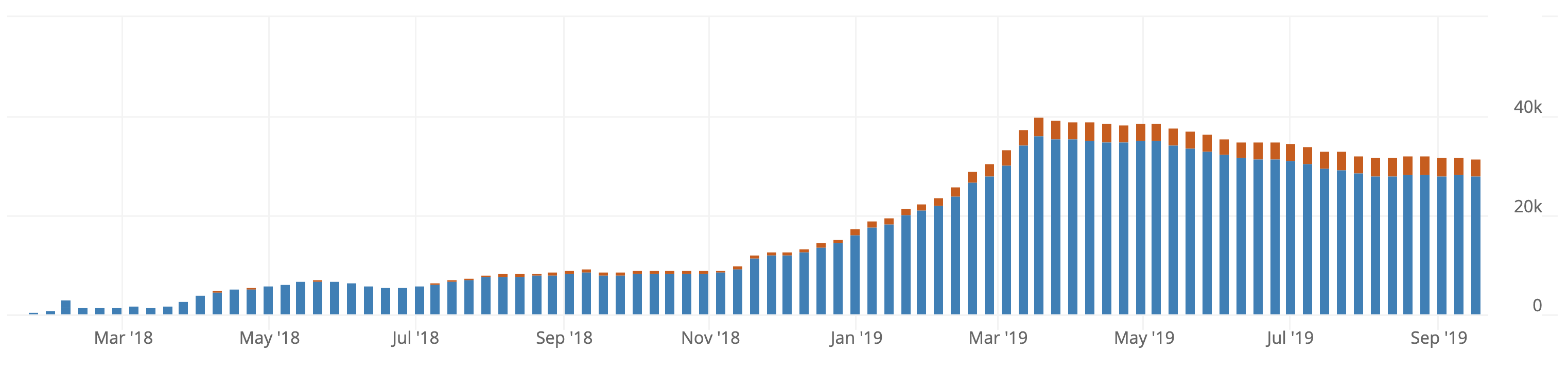

So, is actual value being sent in those transactions? Or are these all transactions that transfer pennies just to simulate network activities? Well, let’s have a look at the USD value of these transactions, per day.

Chart provided by blockchain.com

The peak of 2017 is clearly visible, but we also see that as of early 2019, the value being moved around on the bitcoin blockchain is increasing once again.

Just to put this into scale: on an average day in 2019, over $1.500.000.000 is being sent between parties.

That’s one point five billion dollars. The exchange volume (people trading bitcoin on exchanges) is even multitudes higher, but isn’t visible on the blockchain (this sits centralized at the exchanges). The graph above shows the real value of transactions between 2 or more addresses.

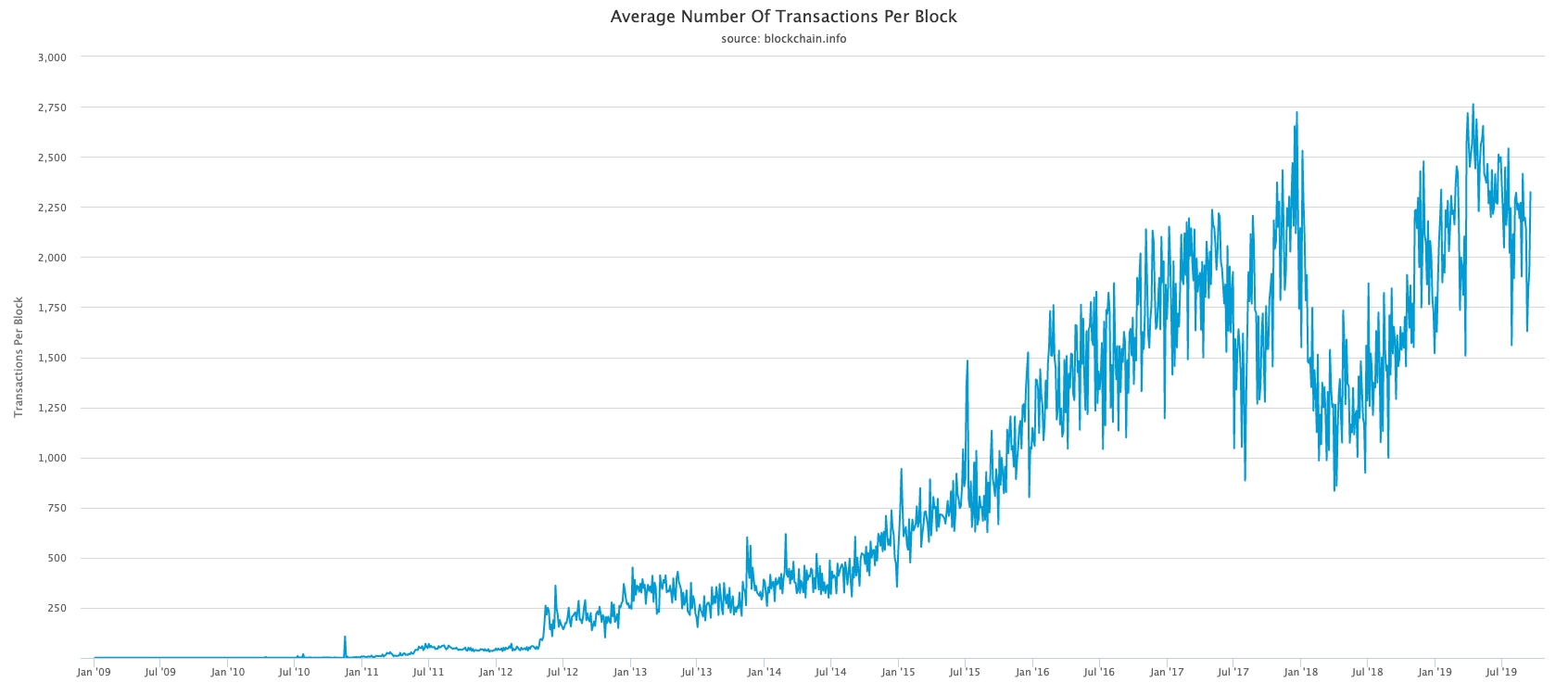

Transactions per bitcoin block

Every 10 minutes (give or take) a new bitcoin block is mined. In that block, transactions are confirmed and forever secured on the blockchain.

Because the open source technology that is bitcoin keeps improving, we can see that it’s now possible to store more transactions per block. This in turn increases the throughput or the theoretical maximum amount of transactions/second that can be sent.

Chart provided by blockchain.com

I’ll cover the technical aspects of why this is possible later in this post.

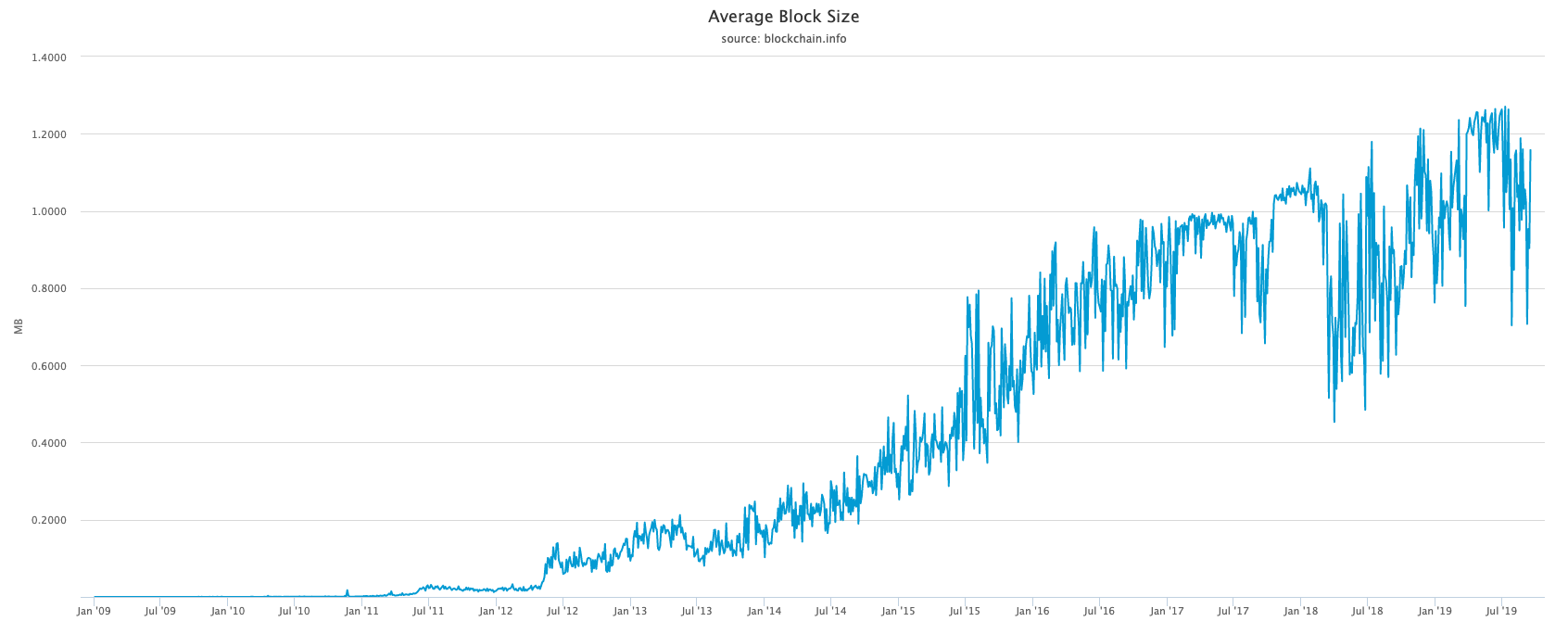

Because more transactions can now fit in a single block, the size of each block has increased as well. This means it’s taking up more space per block on your hard drive.

An average bitcoin block contains around 1MB worth of transaction details. Since every 10 minutes a new block gets produced, the size of the blockchain will only increase. You can enable pruning, to delete older blocks, but you wouldn’t be able to fully verify all transactions then.

Chart provided by blockchain.com

Off-chain transactions on the Lightning Network

The Lightning Network is a “layer 2” scaling solution for bitcoin.

In short: bitcoin is limited in how many transactions per second it can do. The idea of the Lightning Network is to have one transaction on the bitcoin blockchain to start a series of off-chain payments. You can then exchange with other Lightning Network users in near real-time (< 1s confirmations).

Once in a while, you would commit or confirm your balance to the bitcoin blockchain. This might be in the order of 10 off-chain transactions for 1 on-chain transaction, or even higher in a 100/1, 1000/1 or 10000/1 ratio. It would depend on the amount of risk you’re willing to take by not anchoring your payments on the base layer.

There’s a pretty good explanation on the Coin Telegraph site about how Lightning works.

Suffice to say: we might see more transactions on the Lightning Network than on the bitcoin base layer, and that’s a good thing. So, how are these transactions doing on the lightning network?

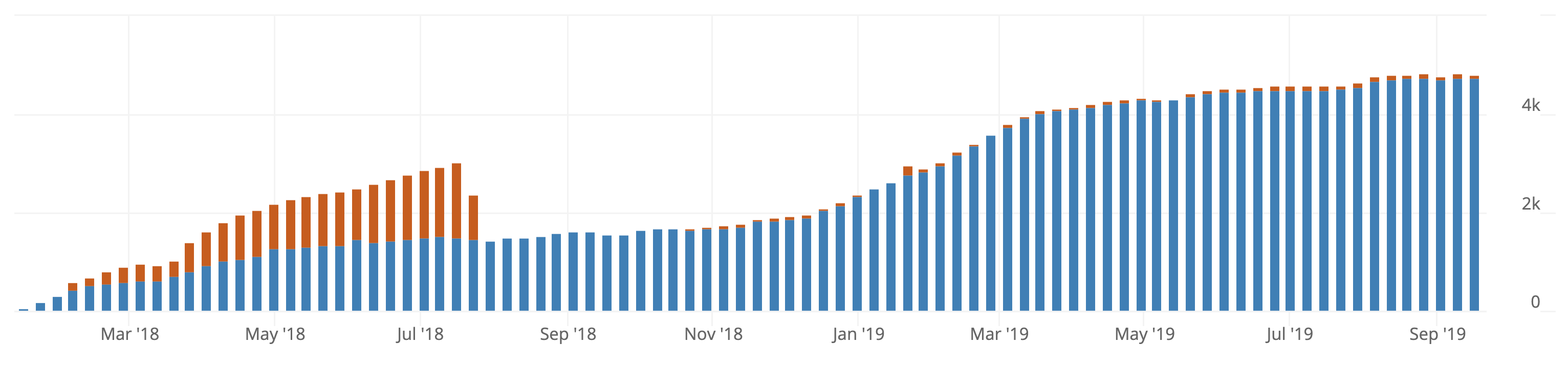

Well, this is where it gets tricky. It’s hard to measure. There’s no central blockchain anymore. There’s no way to tell how many transactions/s are actually happening. We can look at other metrics though, like the size of the Lightning Network in terms of capacity available and amount of nodes active.

Chart provided by bitcoinvisuals.com

Considering how the Lightning Network is only operational since early 2018, I find having more than 4.000 online nodes to be a fairly good place to be at. It’s far from stable and in active development.

Among those nodes, they hold over 30.000 channels open between them. A channel allows money to flow from one address to another.

Chart provided by bitcoinvisuals.com

We see stagnation in the amount of nodes. There was a large increase in early 2019 when there was a fair amount of media attention for Lightning, but we see that effect dry up now. There would need to be new incentives to increase both awareness and adoption of the Lightning Network.

Considering Twitter’s Jack Dorsey is an investor in a company creating Lightning Network software, there’s reason to believe this might one day be integrated in either the Cash App or Twitter itself, enabling micro-payments.

Technological improvements

The codebase of bitcoin itself is hosted on github.com/bitcoin/bitcoin. Everyone’s free to see what is happening and follow the discussions around it.

Improvements to the bitcoin protocol get proposed in a “BIP”: Bitcoin Improvement Proposal. Think of these like the RFCs for the internet.

Here’s what currently being developed & tested:

- Schnorr signatures: a better & more compact algoritm to replace ECDSA

- Scriptless Scripts: a means to execute smart-contracts off-chain (uses Schnorr signatures).

- MAST: a smarter way to encode scripts on the blockchain, without revealing the entire script

- Taproot: this will allow a script (or “smart contract”) to be indistinguishable from a regular transaction, increasing privacy

On the Lighting Network side, there’s a lot of activity around these technologies:

- Atomic Multipath Payments: the ability to pay $10 over 5 different channels with each $2 on them

- Dual funded channels

- Eltoo: a safer/better way to ensure no one cheats on the lightning network, by broadcasting an outdated balance

- Rendez-Vous routing: a solution to combine private & public routing on the Lightning Network

- Splicing: adding capacity to an existing channel without closing it

- Submarine Swaps: using on-chain bitcoin to pay a Lightning Network invoice, without first opening a channel (seamless payments of Lightning, essentially)

- Trampoline Payments: introducing a “router” to route the payments to the next hop, instead of putting the calculation-burden on the client

- Watchtowers: intermediary nodes that will watch your Lightning Network channels and prevent someone fraudulently closing your channels

- Ant routing: a new way to route payments, with nodes only having to keep details about their close neighbours for sending payments

There’s a ton of movement in this space, but it’s mostly hidden from the outside world. And it’s complicated. I mean really complicated.

So, is bitcoin dead?

From what I can see, it’s far from dead. It’s technology that has never been in a better shape.

The improvements being discussed and implemented, the increase in network usage, the amount of organizations implementing and building services on top of the network, … it’s all growing.

I’m excited for the future of both bitcoin and the Lightning Network and I’m struggling to keep up with everything that’s being developed. Especially on the Lightning Network side, things are moving fast. New tech gets introduced and deployed in a matter of months, whereas the bitcoin base layer is much more conservative and will favor stability and security over anything else.

Whether you like bitcoin or not is – of course – entirely up to you. But what I see being built (both the companies and the technology & protocols) is giving me a lot of confidence in the future of bitcoin. It might stay a niche sector, like many open source solutions, but it’s solving real-world problems for a lot of users out there.

Staying up-to-date

These are some of the sources I use to stay informed on what’s happening on the tech side of bitcoin & Lightning:

- Mailing lists

- [bitcoin-dev]: high traffic discussions around BIPs, protocols, …

- [bitcoin-core-dev]: low volume mailing list, announcements for major releases etc.

- [lightning-dev]: high traffic discussions around improvements & protocols

- Bitcoin Optech newsletter: a weekly newsletter, summarizing the changes in bitcoin (PRs, discussions, …)

- Bitcoin merges: all changes making it to the bitcoin core codebase

- BIPs: all improvement proposals for bitcoin

There are many dedicated websites covering bitcoin too, but too many are just focussed on the price. Purely technical publications are rare, and I highly recommend Bitcoin Optech’s weekly newsletter to stay informed.